We're here to help!

Find answers to common questions. If your question isn’t here, feel free to reach out.

General

Why use Leaprr?

Unlike any other trading journal, we focus on functionalities to help retail traders develop the mindset needed to become consistent and profitable.

Will Leaprr help me thrive as a trader?

Building a profitable trading process with solid trading behavior is essential. We provide tools to help you stay on top of your game and drive success.

Consistency is key to avoiding account destruction and safeguarding your mental capital.

What insights are available?

We offer comprehensive trading insights in our journal, focusing on tools that help traders stay consistent and develop good habits.

Is Leaprr free to use?

Yes, registered users can log up to 5 positions per month with all the trading insights for free.

For unlimited logging, we offer monthly and yearly subscriptions.

Why use Leaprr?

Unlike any other trading journal, we focus on functionalities to help retail traders develop the mindset needed to become consistent and profitable.

Will Leaprr help me thrive as a trader?

Building a profitable trading process with solid trading behavior is essential. We provide tools to help you stay on top of your game and drive success.

Consistency is key to avoiding account destruction and safeguarding your mental capital.

What insights are available?

We offer comprehensive trading insights in our journal, focusing on tools that help traders stay consistent and develop good habits.

Is Leaprr free to use?

Yes, registered users can log up to 5 positions per month with all the trading insights for free.

For unlimited logging, we offer monthly and yearly subscriptions.

Using the app

How do I add a trading journal?

When you first download the app, you will be prompted to add your first trading journal. Simply add a name and a starting balance for your trading account.

You can change the name and balance on the account anytime by going into Menu > Tap the name of your journal

For additional trading journal, you will need to subscribe to Leaprr Pro.

Adding a position

1. Tap the "+" button in the Open position panel.

2. Select the market type.

3. Add the Ticker symbol.

4. For a long position, tap the "+" button in the Buy column. For a short position, tap the "+" button in the Sell column.

You can add addition trades by tapping on the "+" button on the Buy or Sell column.

Closing a position

Assuming you have an open long position:

1. In the “Trades” tab of the position, tap the "+" button in "Sell" column to enter a sell record.

2. Enter the "Price", "Quantity", and "Date" to close the entire Long position.

3. If the entire position is sold (quantity is 0), the last record will display "CLOSED".

4. The closed position will be moved to the "Closed" section on the main dashboard.

Deleting a position

1. On the Open Position of the main page, swipe left on the symbol you want to delete.

2. Tap the trash can icon to delete the position.

or

1. Goto summary of the trade you want to delete, tap the delete button in the top right corner.

Adding a strategy

Selecting a Strategy

-------------------

In the review tab of a specific trade, simply select the strategy you're using for the trade.

Tracking the performance of a strategy will allow further optimization. Have at least 100+ trades in order to accurately evaluate a specific strategy.

Add a Tag

----------

In the review tab of a specific trade, tap "+" to add custom tags .

Reviewing trades has never been easier. You can create custom tags to track specific trading behaviors, mistakes, or price action that is important to you to help improve your trading performance.

How do I add a trading journal?

When you first download the app, you will be prompted to add your first trading journal. Simply add a name and a starting balance for your trading account.

You can change the name and balance on the account anytime by going into Menu > Tap the name of your journal

For additional trading journal, you will need to subscribe to Leaprr Pro.

Adding a position

1. Tap the "+" button in the Open position panel.

2. Select the market type.

3. Add the Ticker symbol.

4. For a long position, tap the "+" button in the Buy column. For a short position, tap the "+" button in the Sell column.

You can add addition trades by tapping on the "+" button on the Buy or Sell column.

Closing a position

Assuming you have an open long position:

1. In the “Trades” tab of the position, tap the "+" button in "Sell" column to enter a sell record.

2. Enter the "Price", "Quantity", and "Date" to close the entire Long position.

3. If the entire position is sold (quantity is 0), the last record will display "CLOSED".

4. The closed position will be moved to the "Closed" section on the main dashboard.

Deleting a position

1. On the Open Position of the main page, swipe left on the symbol you want to delete.

2. Tap the trash can icon to delete the position.

or

1. Goto summary of the trade you want to delete, tap the delete button in the top right corner.

Adding a strategy

Selecting a Strategy

-------------------

In the review tab of a specific trade, simply select the strategy you're using for the trade.

Tracking the performance of a strategy will allow further optimization. Have at least 100+ trades in order to accurately evaluate a specific strategy.

Add a Tag

----------

In the review tab of a specific trade, tap "+" to add custom tags .

Reviewing trades has never been easier. You can create custom tags to track specific trading behaviors, mistakes, or price action that is important to you to help improve your trading performance.

Insights glossary

Average Account PnL%

This metric shows your average account profit and loss in percentage of all your trades during a specific period (Lifetime, weekly, monthly, and yearly). Instead of focusing on your P/L amount, focus more on the percentage to maintain a good trading mentality.

Average Peak Value and Max Drawdown

Maximum drawdown metric shows the largest decrease in value of your portfolio from its peak value to its lowest point before a new peak is achieved. It’s expressed in percentage terms and is used as an indicator of downside risk over the lifetime period.

Equity Curve

The equity curve shows the overall health of your account. You should always monitor for big swings in your equity curve and maintain a steady growth. If big swings occur, this could mean an inconsistent execution in your process.

Green vs Red Days

The Green vs Red Days is a overall view of your daily P/L performance. It is important to focus on achieving more green days than red days and less on your P/L to protect your mental capital and improve your consistency in the long term.

In addition, recognition of behaviours such as when to stop trading, over-trading or revenge trading could determine the performance of this insight.

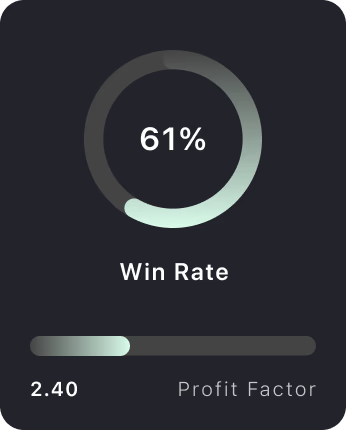

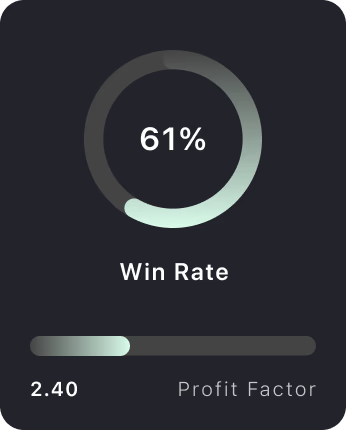

Profit Factor and Expectancy

Profit Factor

The ratio between gross profits and gross losses is the profit factor. If you have a process that has accumulated 500 in profits and 250 in losses, the profit factor is two.

A profit factor is higher than 1.75 is usually a very good number for a trader with a healthy growth on your equity curve.

Profit Factor below 1.0 means that the trading system is loss-making.

Profit Factor within 1.0-1.5 means that the trading system is relatively profitable.

Profit Factor within 1.5-2.0 means that the trading system is highly profitable.

Profit Factor above 2.0 means that the trading system is extremely profitable.

Expectancy

The expectancy helps you to determine the expected profit or loss of a single trade after taking into consideration all of your past trades. With this, you are always looking for a positive expectancy to show that your overall trading is profitable.

Positive Expectancy

A trader who wins 4/10 trades with an average profit of $500 and average loss of $120.

The trading expectancy calculation is:

0.4 is 40% Win Rate

$500 is the average win

0.6 is 60% Loss Rate. The average win and loss percentage must add up to 100

$150 is the average loss

The trader's expectancy is positive. Over 10 trades, the profit is $1,280 (10 x $128), while the loss is $720 (10 x $72).

(0.4 x $500) – (0.6 x $120) = $200 – $72 = $128

Negative Expectancy

For many new traders, the result is more complicated. Typically, new traders make smaller gains and larger losses. This reflects in a negative score that reveals the true scale of losses even when the stats show a trader seems to be a winner. This time, the trader wins 70 per cent of the time with a profit of $125, but the losses average $500.

The trade expectancy calculation is:

(0.7 x $125) – (0.3 x $500) = 87.5 – 150 = -62.5

This time, the negative result shows the trader is losing money and the higher the number, the bigger the loss.

The formula confirms the trader gains $875, winning seven out of ten trades, but the loss from the remaining three trades is $1,500, leaving the trader $625 in the red. The takeaway is that a trader can have a great win tally, but the losses can still mount if the profits are low.

Win Rate

Your win rate shows how many trades you win out of all your trades. For example, if you make 5 trades a day and win 5, your daily winrate is 3/5, or 60%. If there are 20 trading days in the month, and you win 60 out of 100 trades, your monthly win rate is 60%.

Your win rate does not tell you how profitable you are, you can have a high win rate and stay flat on your account or a low win rate with high returns. The key is having big winners that covers most of your small losses.

Average Account PnL%

This metric shows your average account profit and loss in percentage of all your trades during a specific period (Lifetime, weekly, monthly, and yearly). Instead of focusing on your P/L amount, focus more on the percentage to maintain a good trading mentality.

Average Peak Value and Max Drawdown

Maximum drawdown metric shows the largest decrease in value of your portfolio from its peak value to its lowest point before a new peak is achieved. It’s expressed in percentage terms and is used as an indicator of downside risk over the lifetime period.

Equity Curve

The equity curve shows the overall health of your account. You should always monitor for big swings in your equity curve and maintain a steady growth. If big swings occur, this could mean an inconsistent execution in your process.

Green vs Red Days

The Green vs Red Days is a overall view of your daily P/L performance. It is important to focus on achieving more green days than red days and less on your P/L to protect your mental capital and improve your consistency in the long term.

In addition, recognition of behaviours such as when to stop trading, over-trading or revenge trading could determine the performance of this insight.

Profit Factor and Expectancy

Profit Factor

The ratio between gross profits and gross losses is the profit factor. If you have a process that has accumulated 500 in profits and 250 in losses, the profit factor is two.

A profit factor is higher than 1.75 is usually a very good number for a trader with a healthy growth on your equity curve.

Profit Factor below 1.0 means that the trading system is loss-making.

Profit Factor within 1.0-1.5 means that the trading system is relatively profitable.

Profit Factor within 1.5-2.0 means that the trading system is highly profitable.

Profit Factor above 2.0 means that the trading system is extremely profitable.

Expectancy

The expectancy helps you to determine the expected profit or loss of a single trade after taking into consideration all of your past trades. With this, you are always looking for a positive expectancy to show that your overall trading is profitable.

Positive Expectancy

A trader who wins 4/10 trades with an average profit of $500 and average loss of $120.

The trading expectancy calculation is:

0.4 is 40% Win Rate

$500 is the average win

0.6 is 60% Loss Rate. The average win and loss percentage must add up to 100

$150 is the average loss

The trader's expectancy is positive. Over 10 trades, the profit is $1,280 (10 x $128), while the loss is $720 (10 x $72).

(0.4 x $500) – (0.6 x $120) = $200 – $72 = $128

Negative Expectancy

For many new traders, the result is more complicated. Typically, new traders make smaller gains and larger losses. This reflects in a negative score that reveals the true scale of losses even when the stats show a trader seems to be a winner. This time, the trader wins 70 per cent of the time with a profit of $125, but the losses average $500.

The trade expectancy calculation is:

(0.7 x $125) – (0.3 x $500) = 87.5 – 150 = -62.5

This time, the negative result shows the trader is losing money and the higher the number, the bigger the loss.

The formula confirms the trader gains $875, winning seven out of ten trades, but the loss from the remaining three trades is $1,500, leaving the trader $625 in the red. The takeaway is that a trader can have a great win tally, but the losses can still mount if the profits are low.

Win Rate

Your win rate shows how many trades you win out of all your trades. For example, if you make 5 trades a day and win 5, your daily winrate is 3/5, or 60%. If there are 20 trading days in the month, and you win 60 out of 100 trades, your monthly win rate is 60%.

Your win rate does not tell you how profitable you are, you can have a high win rate and stay flat on your account or a low win rate with high returns. The key is having big winners that covers most of your small losses.